Balancing Your Cash Drawer: Key Steps for Accuracy

Running a successful business is all about taking care of the finer details, not leaving anything to chance, and keeping a very, very close eye on your incomings and outgoings.

Knowing how to balance the cash drawer, how much cash should be in your float, and addressing cash flow discrepancies is a fundamental part of your job as a business owner.

All too many of us are guilty of letting due diligence slip a little from time to time. If you’ve gotten used to not thinking twice about what’s actually going on in your cash drawer at the start and end of each day… well, you’re possibly doing your business a disservice, and at risk of making some significant mistakes.

This week, we’re going to be taking a step-by-step look at how to balance your cash drawer, as well as some top tips on good cash drawer practices and basic cash control.

By bringing this advice into your daily routine, you’re going to be taking better care of your bottom line, and eradicating a handful of risks that could lead to significant problems if left unchecked.

Why Is It Important to Balance Your Cash Drawer?

When it comes to business best practices - not least in the restaurant industry, where incomings and outgoings need to be carefully balanced - keeping a laser focus on your cash flow is paramount. Balancing your cash drawer at the end of each day is a major aspect of this, and in an age when payment types are constantly evolving, it’s important to take some time to ensure you’re truly doing what you can to take care of your best interests.

Essentially, everything that comes into your business needs to be accounted for. Cash payments are just the tip of the iceberg; credit cards, debit cards, vouchers, and mobile payment methods such as Apple Pay all come together to provide a clear picture of exactly where your business is at financially. Keeping your attention on that picture is key to addressing issues, planning for the future, and promoting growth.

The other side of this particular issue has to do with trust and accountability. While you might have a close-knit team of beloved employees, any business that deals with cash inflow and transactions need to have a set of procedures and protocols in place to reduce risk, increase trust, and ensure accountability.

Having an iron-clad set of practices is the surest way to protect you and your business, as well as to protect your staff members.

Make no mistake, cash handling mistakes happen on a daily basis to the best of us, and theft and fraud are unfortunate realities that come with entrusting your cash flow to other people. What’s more, you’ve got to take care of your customers, too - nobody likes to be short-changed, and cash discrepancies are often a clear sign that mistakes are being made and need to be rectified.

Let’s take a look at some winning practices that should be part of your daily cash-based routine - no exceptions, no excuses.

Start Each Day By Counting The Cash in Your Drawer

Knowing how to balance a cash drawer isn’t just about what goes on at the end of each shift, it’s also about getting each day started with good practices in place. Our advice? Begin every day by counting up the cash that’s still in your till.

Your restaurant needs a consistent base quantity of cash in your cash drawer at all times. Even in an age when cash payments are on the decline, they still form the basis for a significant proportion of transactions… and we all know just how annoying it is to be a customer who makes a cash payment, only to discover the merchant is lacking change to give.

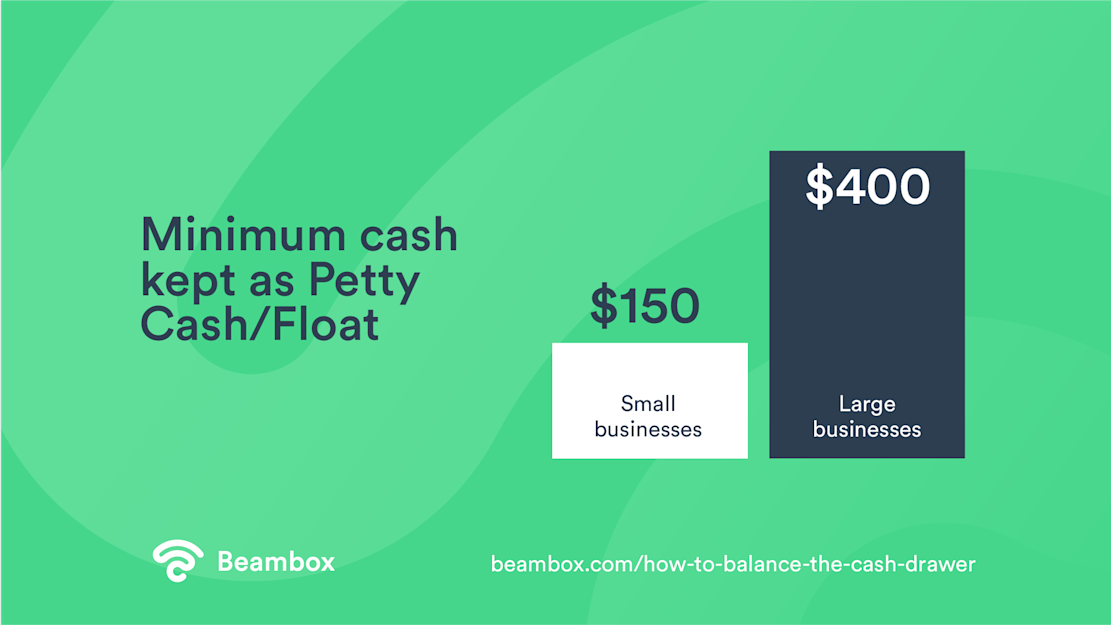

This base quantity of cash, known as a float or petty cash, will naturally vary from business to business. However, knowing how much petty cash to have in your float shouldn’t be a difficult conclusion to come to, as daily experience will let you know what works and what doesn’t.

A general rule of thumb says that for smaller businesses, about $150 of petty cash should suffice, and larger businesses may need up to $400.

One Staff Member, One Cash Drawer

OK - for smaller businesses relying on a single cash register, this might not be the most practical approach. However, controlling and limiting the number of staff members responsible for individual cash drawers is never a bad idea.

It all comes down to accountability. The more individuals with access to single cash drawers you have, the thinner that accountability is spread. While this is all well and good when there are no problems, as soon as discrepancies arise and suspicions are raised, it becomes a serious issue, and it can be very difficult to pinpoint who is responsible for missing cash or mistakes that have been made.

Should Cash Be Deposited Throughout Each Day?

If possible and practical, then yes - absolutely it should. Obviously, this might be difficult for smaller restaurants and bars with limited staff members.

However, if you’re able to capitalise on quiet hours throughout the day, making an effort to count and deposit cash from your till will diminish the opportunity for mistakes to be made, and provide additional peace of mind and accountability.

We’d recommend:

Establishing set times each day for cash to be counted and deposited to ensure consistency and a good routine Always having two staff members witness each count Taking notes (in a diary or on a smart device) of totals, discrepancies, and the names of staff members involved to reduce the chance of mistakes Ensuring you know how much money should be in your float or petty cash after the deposit

Best Practices For End of Day Cash Drawer Checking

We all look forward to the end of a business day - it’s your chance to bask in the glories of your success, put your feet up with a drink, and make sure every box is ticked. It’s also the best time to oversee your cash drawer practices and make sure that money was flowing in and out of your till honestly, efficiently, and with your business’ best interests at heart.

The most fundamental aspect of this is carefully counting the total amount of cash in your cash drawer, and accounting for all types of transactions received throughout the day. Once everything is added up, you’ll compare your total with the total given by your POS.

Fingers crossed, this amount should align perfectly. However, this isn’t always the case, and if there is a mismatch you may have to do some investigation.

Don’t panic if it’s an insignificant amount - small discrepancies are part and parcel of daily business, and are most commonly caused by a staff member making mistakes when giving change or receiving payments. However, if you’ve noticed a bigger discrepancy, you’re going to have to dig a little deeper.

What Happens When a Cash Drawer is Over?

An overage means that there’s more cash in your cash drawer than your POS says there should be.

While it’s tempting to see this as a good thing (more cash means more profit, right?) it usually means that a customer has been short-changed. If they realise this has happened, you’re at risk of losing a customer or receiving poor online reviews.

What Should I do if a Cash Drawer is Under?

There are a few reasons why you might be missing cash at the end of the day. Human error can sometimes result in a $10 bill being given as change instead of a $5, and money can be lost by mistake. Of course, there’s the possibility a staff member is slipping cash into their pockets, which raises a whole number of issues that would have to be dealt with in accordance with your business policy and local legal procedures.

Whether your discrepancies are over or under, cash drawer issues should be dealt with by establishing a crystal-clear policy for all staff members to follow. Transparency, accountability, and visibility is key, and building trust and setting rules in stone will always help avoid cash problems from arising.

Knowing How to Balance Cash Register Transactions Will Help Your Business

There’s no getting away from the fact that understanding and implementing best cash drawer practices will bring benefits to your business. In the restaurant and bar industry, cash transactions come quickly and (hopefully) consistently, and remaining diligent by checking and depositing cash throughout the day will keep your profits healthy, your mindset positive, and your team united.

While a good POS system will help with accuracy, there’s really no replacement for common sense, care and attention, and a team pulling in the same direction. Payment methods may be changing, but sensible cash drawer policies and daily checking and balancing is here to stay.

Get Started With Free WiFi Marketing

Beambox helps businesses like yours grow with data capture, marketing automation and reputation management.

Sign up for 30 days free