Restaurant Budget Strategies: Optimize Costs and Boost Profits

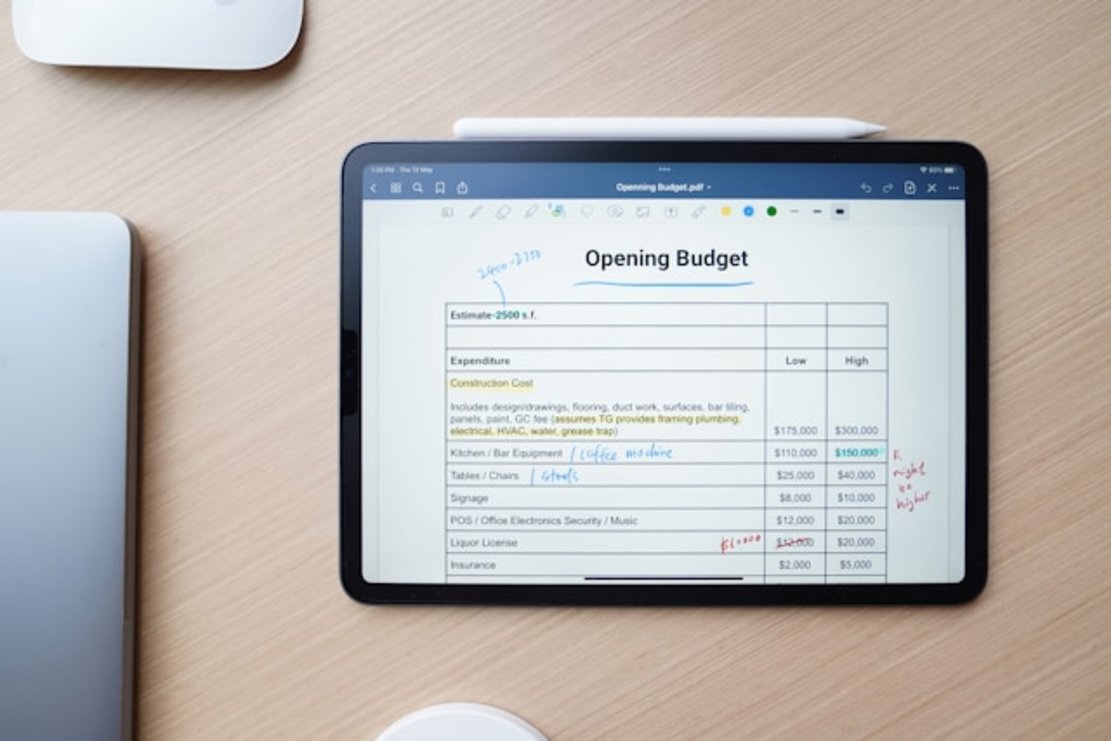

A restaurant budget is the foundation for your eatery’s financial health and helps you make better decisions for your establishment. It determines whether your restaurant can balance its books, become profitable, or operate at a loss.

This guide shows how to budget for a restaurant to keep your restaurant’s finances above water. Continue scrolling to learn how to keep various costs in your profit and loss statement in check.

Key Components of a Restaurant Budget

First, let’s outline the key components of your restaurant’s budget plan so you know what to monitor:

- Sales Revenue: Your sales revenue significantly influences your eatery’s cash flow, budget, and profit margins.

- Prime Cost: The prime cost shows your restaurant’s profitability as a business. It accounts for the total cost of goods sold (COGS) and labor costs. These are two of the most significant expenses your eatery has to bear. The cost of goods sold represents the amount you must pay for all the ingredients in your menu. Labor costs include healthcare, payroll taxes, and employee benefits. 3.__ Marketing__: You must have a marketing budget to ensure your restaurant continues to bring new and returning customers.

- Operating expenses: Operating expenses are the various costs you must consider for running your restaurant smoothly daily. This includes utilities like rent, electricity, and internet. You may also have to account for equipment maintenance and replacement.

- Net profit: Net profit is how much is available to your business after accounting for all expenses.

As you can see, these components are essential for managing your restaurant.

Understanding Fixed vs. Variable Costs in Restaurant Operations

The second step in how to create a restaurant budget is understanding the differences between fixed and variable costs.

Fixed Costs

Fixed costs remain consistent over time, making them easier to account for in your budget. Moreover, you’ll have to pay these expenses when opening your restaurant. Here are some examples of fixed costs:

- Rent

- Insurance premiums

- Loan payments

- License fees

- Software subscriptions, like your point of sale (POS) system

Variable Costs

Variable costs fluctuate, i.e., they can vary depending on various factors. For instance, your sales revenue and monthly operations affect these costs. Here are some examples of variable costs:

- Food and beverage costs

- Hourly wages

- Payment processing fees

- Utilities

Sales Forecasting: Setting Revenue Expectations

Sales forecasting is estimating how much revenue your restaurant will generate in the future. It’s important because it gives an estimate to balance your budget based on realistic costs and revenue. The following sections highlight how to forecast sales for your restaurant budget breakdown.

Techniques for Estimating Monthly and Seasonal Sales

Use the following techniques to estimate the monthly and seasonal sales for your eatery:

- Trend analysis: In trend analysis, you use the previous sales data to look for patterns. Use these patterns to forecast sales for your eatery.

- Calculate your restaurant dining capacity: The restaurant’s dining capacity is the maximum number of people your restaurant can accommodate. You must know the number of tables, seating capacity, table turnover rate, and average check size. Use this to forecast sales when your restaurant is at half capacity or business is slow.

- Time series analysis: For time series analysis, you collect data at different periods and record the changes. You can use this information to forecast sales.

- Monitor external factors that affect sales: You look at external factors, such as political, economic, social, and technological changes, because they affect your sales.

Importance of Analyzing Historical Sales Data

Historical sales data is valuable for your restaurant because:

- It highlights the peak busy and slow times for your restaurant.

- It shows the most popular dishes in your restaurant.

- It points out where you can improve by comparing your current and historical sales data.

With this information, you can use sales forecasting to get a realistic budget for your restaurant.

Managing Labor Costs: Your Greatest Expense

The biggest expense in your budget is labor costs. This is the amount you have to pay your staff. You must pay attention to what percentage it is in your budget because it helps manage your finances.

All Labor-Related Expenses

Here are all the labor-related expenses you must account for in your cafe or restaurant’s budget:

- Employee benefits

- Healthcare

- Payroll taxes

- Salaries and wages

- Sick days

- Worker’s comp

Essentially, any costs you must bear for your labor, i.e., staff, come under labor-related expenses.

Strategies for Controlling Labor Costs

The following strategies are effective for keeping your monthly restaurant budget for labor costs in check:

- Train and reward your staff: Turnover is expensive for your restaurant. You need to invest in recruiting to find employees who are the right fit for your eatery. Moreover, you also have to train them. You can reduce turnover by rewarding your top-performing staff. Another option is to create a pathway for employees to grow.

- Optimize your staff’s schedules: Use your sales forecast to plan your staff’s schedule. It can reduce costs because your employees won’t have to work overtime. On top of this, it also improves their efficiency because it becomes easier to manage their workloads.

- Provide adequate training: Training ensures your new staff is ready to work in your restaurant. It improves efficiency because they’ll know what to do in your eatery. Create a handbook and allow your recruits to shadow your best staff.

Food and Beverage Costs: Optimizing Menu Pricing

Budgeting for food and beverage costs is essential for your restaurant to become a profitable venture. It ensures you don’t unnecessarily acquire ingredients. Moreover, it influences your menu pricing.

Use the following strategies to ensure the food and beverage restaurant expense categories don’t exceed your budget:

- Build strong relationships with reliable vendors: Look for vendors that provide high-quality ingredients at reasonable market rates. The goal is to reduce raw ingredient prices without compromising on quality.

- Reduce food wastage: Food waste can be expensive, especially if unchecked. Train your staff to ensure they serve the right orders to your guests. You should also plan your menu and store ingredients properly to reduce food wastage.

- Pay attention to portion sizes: Standardize the portion sizes because it helps with inventory management and reduces food waste. You want your customers to feel satiated when they eat at your restaurant.

- Monitor the prices of ingredients: Ingredients, especially seasonal ones, can fluctuate significantly in price based on demand. Your menu’s pricing strategy must account for these fluctuations.

Utility Management: Controlling Consumption Costs

Utilities are essential in ensuring your restaurant runs as expected. Electricity, phone, water, and internet bills will come under this category. Here’s how you can manage these costs in your budget:

- Analyze your utility bills: Go through your utility bills to understand where you’re spending money. If there’s a service you don’t or barely use, consider stopping the subscription.

- Install energy-saving equipment: Energy-saving equipment, especially appliances with ENERGY STAR labels, can save hundreds of dollars in utility bills over their lifespan. Similarly, install smart systems that automatically turn off when not in use.

- Train your staff on energy conservation practices: Provide adequate training for your staff to reduce energy consumption. For example, turn off the lights when they’re not in use.

The Role of Rent and Occupancy Costs in Budgeting

Rent and occupancy costs are one of the biggest fixed expenses in your restaurant business’s budget. Occupancy costs include maintenance costs, insurance, common area maintenance fees, and property taxes. You must remember that these expenses impact your restaurant’s profitability.

Ideally, your restaurant’s rent shouldn’t exceed 10% of your budget. How much rent you pay depends on your eatery’s location. Use the following strategies to bring down your rent and occupancy costs:

- Negotiate with your landlord: It’s always a good idea to talk to your landlord and see if you can work something out. No matter how small, a discount can give you some wiggle room in your budget. For example, see if you can get a longer lease contract in exchange for a lower rent.

- Sublease additional space: Do you have any space you don’t use in your restaurant? Why not use this space to reduce your rent by subleasing the space to another business? Another solution is to find pop-up restaurants or startup food trucks and see if you can collaborate.

Restaurant Marketing Budget: Attracting and Retaining Customers

Marketing is necessary for your restaurant to ensure a steady flow of guests. A restaurant marketing budget ensures you don’t overspend, which is a common problem.

Your eatery’s budget for your marketing campaigns should range between 3% - 6% of your revenue.

You should also have goals you want to achieve with your advertising efforts. For example, you want to increase your pub’s repeat customers by 10% within 3 months.

These tips will help you make the most of your restaurant’s marketing budget:

- Choose a mix of digital and local advertising solutions: Using multiple marketing solutions is an excellent way to increase your reach without exceeding your budget. For example, use social media and email marketing to reach your target audience digitally. Similarly, use print ads to raise awareness with the locals in your area.

- Set a daily budget for your digital ads: Digital advertising solutions for restaurants allow you to set a daily limit. This ensures you only spend what’s available to your establishment.

- Monitor the digital ads: It’s not necessary that you need to use every digital marketing solution available to restaurants. The best practice is to try multiple services and see which ones offer the best return on investment (ROI). This way, you can optimize how much you spend on future ad campaigns.

Equipment Maintenance and Replacement Costs

Equipment maintenance is vital for your restaurant’s operations. It reduces the time your machines have to be offline because you can fix issues before they cause significant problems. Maintenance also ensures the machines operate efficiently.

Here is how to budget for equipment maintenance and replacement costs:

- Have a fund for preventive maintenance: Make it mandatory to service your equipment regularly. Follow the manufacturer’s recommendations to ensure the machines operate with minimal issues. Preventive maintenance ensures your equipment has a long lifespan. Moreover, it reduces the chances of unexpected breakdowns, which can be expensive.

- Set aside a budget for emergency repairs: Sometimes, things will go wrong, no matter what procedures you follow. Having funds for emergency repairs will allow you to fix unexpected issues quickly. Contact a trusted repair service or the equipment manufacturer to know how much you need for emergency repairs.

- Maintain a fund for replacing your equipment: Your kitchen equipment has a lifespan, expressed as the mean time between failure (MTBF). This metric shows how long you can operate the equipment before it fails. However, this doesn’t mean your equipment will fail after this period. Nevertheless, you must maintain funds for equipment replacement.

Emergency Fund: Preparing for the Unexpected

The last thing you must do is ensure you have an emergency fund in your budget. In this industry, a lot can happen out of the blue. For example, there may be a natural disaster, and you must make substantial repairs to your equipment.

Or you may have to close your restaurant or serve limited dishes due to an epidemic. A financial cushion allows you to absorb unexpected expenses and keep your restaurant afloat.

At the bare minimum, you should have at least three months’ worth of operating expenses as your emergency fund. Aim for six months because it gives you enough time to think and pick the best move for your eatery. Ideally, you want to keep this money separate and only access it when required.

Look at your restaurant cost breakdown to understand how much capital you need for your restaurant’s monthly expenses.

Regular Financial Reviews: Adapting Your Budget

According to the Kansas Restaurant and Hospitality Association (KRHA), 76% of restaurant operators saw an increase in average food costs. This indicates you shouldn’t use the same budget every year because a lot can change over time.

For example, inflation can make buying the ingredients for various dishes expensive. You may see an increase in labor costs because the local government increased the minimum wage.

Sometimes, the unexpected happens, and you just about manage to keep your restaurant running. If you keep the same budget and something similar occurs next year, you may have to close your eatery.

Make it a mandatory practice to review your restaurant’s budget regularly. Choose a frequency, i.e., how often you want to do this with your budget.

Compare every year’s budget and look for patterns in the data. Did the labor cost go up because of overtime?

By analyzing your budget, you’ll get powerful insights on how to improve your budget. For example, it can show whether you need to increase your menu prices. You can identify if you need another supplier to keep your COGS in check.

Regularly reviewing your budget allows you to easily respond to unexpected challenges and sail through difficult times with minimal problems.

Wrapping Up

Restaurant budgeting is necessary to ensure your eatery is stable and profitable in the long run. By understanding the various factors you must account for in your budget, you will have better control over your finances.

Moreover, it gives you an advantage over your competitors because you’ll master how to make the most of what’s available.

As highlighted earlier, you must account for utilities, especially internet bills. Providing guests access to your restaurant’s WiFi is non-negotiable because customers prefer eateries that offer this utility.

Thankfully, it’s easy to make back the money you spend on this utility and related equipment costs like routers. With Beambox’s WiFi marketing solution, you can ensure your restaurant’s network becomes a money-making asset.

Shed light on ongoing offers and discounts, provide updates about your restaurant, and more with your WiFi login page. You can even customize it to match your restaurant’s branding.

Join Beambox today to ensure your restaurant’s WiFi contributes to your budget instead of becoming just another expense!

Get Started With Free WiFi Marketing

Beambox helps businesses like yours grow with data capture, marketing automation and reputation management.

Sign up for 30 days free