Event Venue Profit Margins: How to Grow Your Venue's Revenue

Cash is king, right? To have cash on hand in your business, you need to make a decent profit and not rely heavily on the bank. That’s not easy — particularly in hospitality. But it is possible and made a lot easier to track, providing you understand the basics of profitability.

The golden rule:

Turnover = vanity, profit = sanity

If you’re just getting into the hospitality or event industry, you’ll doubtless have lots of questions about how to become — and remain — profitable. But if you’re an experienced owner, you’ll also know that it’s too easy to forget about the intricacies of profit and how to mitigate cash flow risk.

Let’s get into hospitality and event venue profit margins by starting with the basics.

Related read: Your Post-COVID Business Strategy

What Is a Profit Margin?

Starting a business and beginning trading is difficult without fully understanding how you’ll make money.

It all comes down to your event venue’s profit margin. A profit margin is the percentage of revenue you get to keep after paying all of your outgoing expenses. It can be calculated at any time but is most commonly reviewed monthly, quarterly, and for your fiscal end of the year.

This percentage will also help you determine how much income you’re making on every dollar of sale. For example, if you’re achieving a 35% profit margin, you’ll have a net income of $0.35 for every $1 of sales.

Keeping a close eye on this figure will help you accurately assess business performance and the health of your operation. It’ll also help you plan, budget, and invest safely in the business.

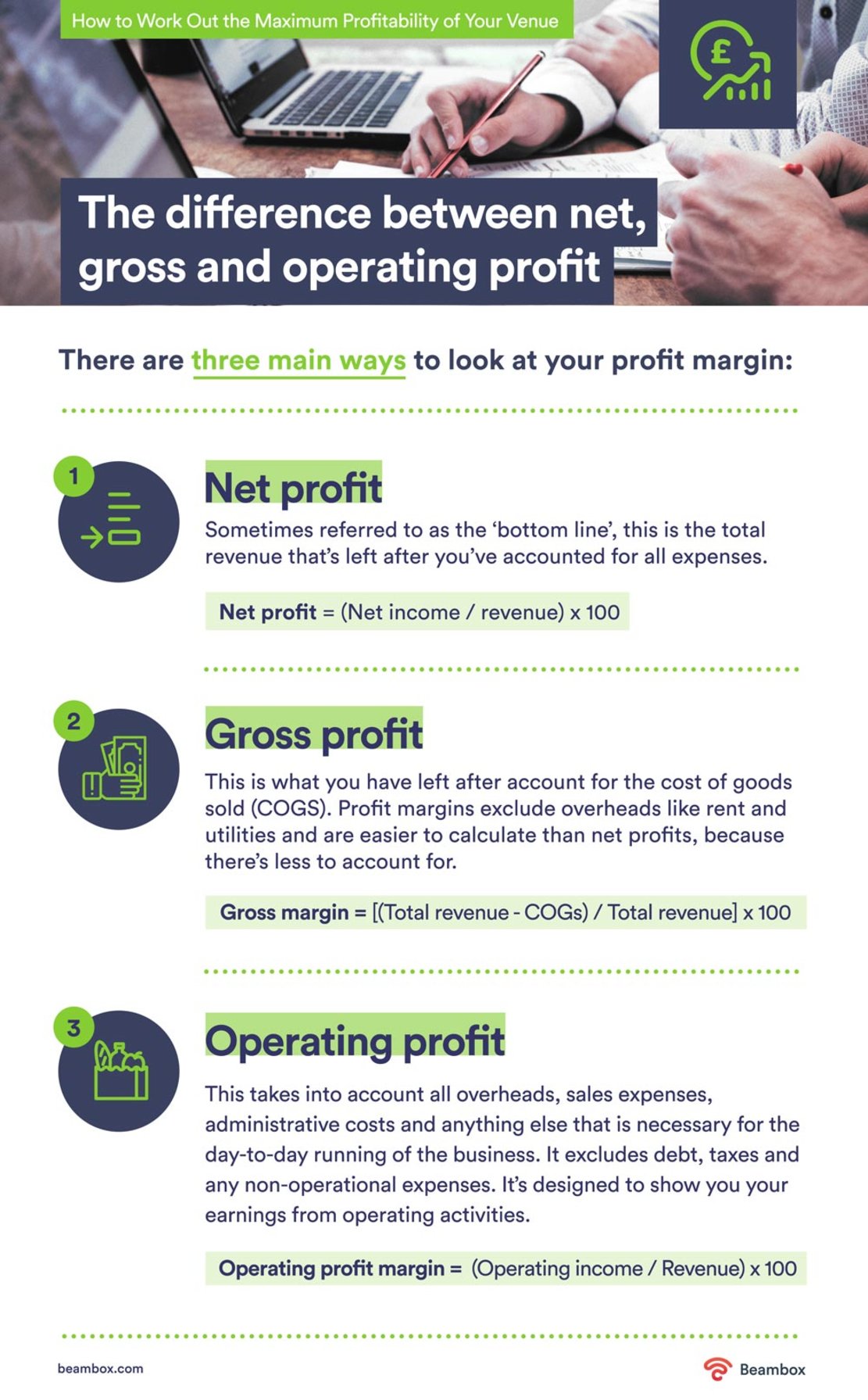

The Difference between Net, Gross, and Operating Profit

There are three main ways to look at your event venue’s profit margin:

Net profit: Sometimes referred to as the ‘bottom line,’ this is the total revenue left after you’ve accounted for all expenses.

Calculation: Net Profit Margin = (Net Income / Revenue) X 100

Gross profit: What you have left after accounting for the cost of goods sold (COGS). Profit margins exclude overheads like rent and utilities and are easier to calculate than net profits because there’s less to account for.

Calculation: Gross Margin = [(Total Revenue - COGS) / Total Revenue] X 100

Operating profit: Takes into account all overheads, sales expenses, administrative costs for services, and anything else that is necessary for the day-to-day running of the business. It excludes debt, taxes, and any non-operational fees. Operating profit shows you your earnings from operating activities.

Calculation: Operating Profit Margin = (Operating Income / Revenue) X 100

Now we understand the mechanics, let’s consider how to calculate growing venue revenue in key sectors: hotels, restaurants, and event venues.

How to Work Out Your Hotel Profit Margin

A healthy hotel profit margin is essential for you to grow and compete against the big chain competition. It’s thought that UK hotels have, on average, around a 32% gross operating profit margin, which isn’t too shabby as event space revenue. By the end of the first quarter of 2022, US hotel profit margins were up to 40.9%. Only 0.2 percent away from pre-pandemic levels.

Here are the simple steps you’ll need to take to work out your hotel’s profitability.

Step 1: Look at Your Expenditure

It’s vitally important that you get a handle on how much your hotel spends on everyday essentials. There’s the obvious stuff — staff labor, services, and electricity, but there are also the easily overlooked elements.

For instance, how much does it cost to clean a room? Which products need regular replenishment? What about laundry — how much are you paying the supplier for that service? And don’t forget those OTAs! How much do you spend on average on commission?

Every month is different in the hotel world, but pick a typical month without surprises and determine every single cost you encounter. This will help you to identify your profits so you know how to grow venue revenue.

Step 2: Calculate Rooms Booked

Work out your average monthly price per room. Then, look at the number of rooms booked. Determine the gross profit from the rooms (see the guide above for the formula for this).

Why work with averages? Hotel room pricing fluctuates regularly, and discounted deals need consideration, so the average will give you the most meaningful profit figure from which to work.

Step 3: Subtract

Now, subtract the monthly expenditure from the average income you’re making on rooms.

This will provide a profit margin for the month. If it’s negative, you’re losing money on every room sale. If it’s positive, you’re growing revenue for your venue and making a profit. Simple.

The number you settle on might come as a bit of a shock. But that’s ok because you know what it is now, which means you can work hard to maximize that net profit.

Look for ways to increase direct bookings by taking advantage of email marketing. Avoiding the OTAs will help immeasurably with your event venue’s profit margin.

Remember that empty rooms aren’t just wasted space; they’re a missed opportunity to increase your net profit.

It’s also vital to look historically at your hotel’s profit margin performance. This will help you identify peaks and troughs that can be planned for in the future.

How to Work Out Your Restaurant’s Profitability

Most successful restaurateurs will agree that your net profit margin will provide the most transparent picture of what’s happening in the business.

It’s thought that the average restaurant profit margin sits between 2-6%. However, it’s possible to achieve net margins of 20% upwards if you run a particularly tight ship.

The simplest way to do this is to work from the following formula:

Net Profit Margin = Net Income/Gross Sales x 100

Calculate your net income by taking your gross revenue for any period and deducting operating expenses like a yearly liquor license. Remember that gross revenue in restaurants derives from all sales of food, drinks, and any additional service offerings of products such as merchandise.

As for operating expenses, these are the costs you incur daily, from the cost of ingredients to the rent, wages, depreciation, utilities, and taxes.

You can do a few things to increase your restaurant’s profit and grow venue revenue, including:

- Reduce the overall cost of food by working closely with your suppliers and focusing on portion control.

- Decrease your overheads by using energy-efficient equipment and reducing waste.

- Review positive company culture examples to incentivize employees and reduce staff churn.

- Use technology to your advantage to balance the books and run a super-efficient operation.

What Can Impact an Event Venue Profit Margin?

Startup costs can plague event venues. Learning how to open a bar to stay profitable is similar to learning how to get your entertainment event venue and wedding venue off the ground. A lot of do-it-yourself work, grit, and business acumen can lead to your success.

Now that you know how to calculate your net profit margin, you might be wondering what obstacles stand in the way for event venues.

Taking on too much debt and overspending are big issues that negatively affect your profitability. Whether you are a wedding venue owner or invested in live music venues, failing to manage your costs will cause the majority of your problems. Remove your financial roadblocks by keeping track of your expenses, as we mentioned.

However, other factors make all the difference in your event venue profits. Besides good financial management, simple marketing strategies have a great impact on growing venue revenue.

Let’s discuss marketing influence and why a business plan can keep you on track for maximum profits.

Marketing Impact on Your Event Venue Business Profitability

Local businesses should keep their event venue profit margin at the top of their mind. From wedding venues to entertainment venues, a bar marketing strategy can boost brand awareness and your company’s reputation.

Here are five things to consider when marketing your local business to keep your annual revenue growing.

- Target Audience. Define the key attributes of your target market through demographics and geographic factors to understand how to market your local business to them. Identifying your target market is the first step to retaining clients over time.

- Location is everything. Convenient areas draw business. If you also offer on-site parking or accommodations, this can increase fees which increases your event space revenue.

- Identify What Makes Your Location Unique. You attract and engage your target audience when you take the best photos for your social media marketing. Potential clients want to find photogenic event spaces. Ensure your photos stand out from the rest to promote your space on social media sites.

- Monetize Your Event Venue’s Free Wi-Fi. WiFi marketing software offers multiple benefits for venue business owners. Leverage your guest’s WiFi to collect data for marketing purposes. Push surveys of your meeting space to receive real-time feedback and easily initiate email marketing and SMS marketing.

- Value Your Reputation. Reputation management for many venues is reactive, but this should not be the case. You will be in high demand when you have an excellent reputation in the event venue business. Capitalize on this by increasing your rates and charging more money.

Why an Event Venue Business Plan is Vital for Wedding Venues and More

One of the biggest mistakes a wedding venue owner makes to grow venue revenue is only seeing their location as a spot for weddings. Are wedding venues profitable and what keeps them growing venue revenue? Diversifying. Host corporate events, small gatherings, and other hybrid events to keep your space occupied and stay profitable.

How can you expand your wedding venue as a go-to local business? Wedding venue owners must re-evaluate their goals and opportunities to get on the right track and grow their event venue’s profit margin.

Get started on the right path by generating a business plan for your event venue and sticking to it. Growing venue revenue is more straightforward when you have an outline for success.

Besides asking what makes your wedding venue stand out from the competition, you need to understand your customers and how you will make money. By identifying your services and client base, you can work on improving your overall customer experience. Stop overlooking additional event revenue opportunities by limiting the types of functions you hold.

Create a profitable event venue by setting up an overview of how you will market and manage your business. Perform competitor research to understand what they are offering the local market and how to prevent potential clients from looking elsewhere.

Creating a business plan roadmap and a financial plan with a top-notch spending management system can minimize your monthly expenditures. Most venues and new businesses lose money when they don’t stick to their business plan and veer off course.

Wrapping Up

Maintaining a healthy profit in any local business is hard work for owners, but ultimately rewarding. We’ve skimmed the surface today on event space revenue, but this base knowledge of profit margins is essential to run a sustainable, growing business.

We’d recommend revisiting this page whenever you suspect something isn’t quite right with your event venue’s profit margin. The answer will often lie in what’s happening with your bottom line.

If you are ready to take the next step in marketing your business, you might consider offering a free guest WiFi solution like Beambox.

Take advantage of WiFi marketing software to drive sales with time-sensitive deals and promos. Boost your brand’s social media presence and climb the ranking platforms by getting more customer reviews.

Start your thirty-day free trial and turn your free WiFi into a machine for growth.

Get Started With Free WiFi Marketing

Beambox helps businesses like yours grow with data capture, marketing automation and reputation management.

Sign up for 30 days free